By Chuck Lemar, Special AFS Contributor

By Chuck Lemar, Special AFS Contributor

One of the more difficult challenges of managing a fitness business is knowing the many available financial solutions out there and which ones are best for you and your business.

Obtaining the most optimal financing for your fitness business may result in thousands to tens of thousands of dollars in savings. Another important element is deciding on a length of term that is long enough to provide you cash flow flexibility as your fitness business grows and also giving you the opportunity for an early payoff without a penalty if you exceed your business expectations.

The last thing, for example, is for your business HVAC to fail, causing you to spend a lot of your time stressing regarding how to pay for it due to how tight your loan payments are rather than focusing on growing your business.

Due to your burning passion to change customer lives, you can often hurry into opening or improving your facility. Without taking the time to consider the right business finance solution, the health of your business can be at risk, which is why it is so important to explore your many options even if the process is slower. In the long run, your health and fitness business will change even more lives due to the financial stability of your business and your peace of mind!

And an often-overlooked financing solution due to the length of processing time is the Small Business Administration (SBA) loan! Do not let the SBA longer processing time and extra paperwork eliminate this solution.

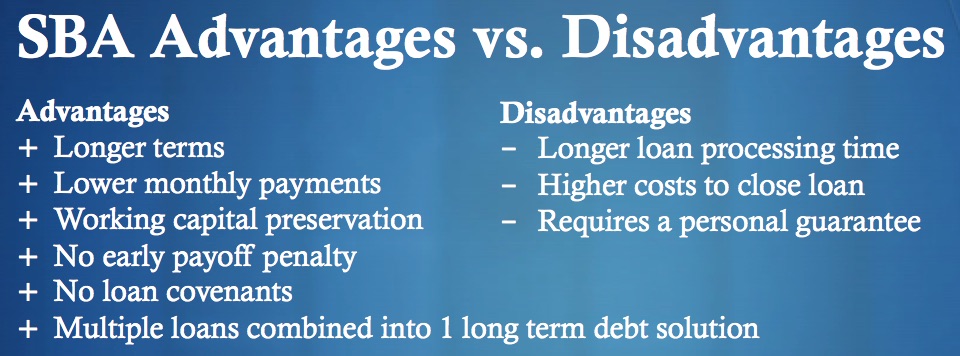

Consider these Advantages and Disadvantages of SBA Financing so you can determine if the SBA is the best or better option for your business:

This can be especially important if you are trying to expand your business quickly to establish your brand before a competitor moves in. Oftentimes, fitness businesses with multiple locations can have multiple loans that can be a burden towards future expansion plans. Combining them into one SBA finance solution can extend those terms and provide you with lower monthly payments. That can help you generate enough business volume to even pay off the loan early, which will not result in a penalty, unlike traditional loans.

Despite the longer loan application processing times, seemingly more paperwork, the higher closing costs, and the requirement of a personal guarantee, many of the clients owning and operating established full-service fitness clubs to start-up group fitness studios have expressed how pleased they were that they pursued the SBA financing option.

After all, shouldn't your focus be on the member experience and their results rather than how to make ends meet during slower fitness times of the year? Taking the extra time to ensure your business' long-term success will result in less stress to you year after year. Your SBA financing can include facility improvements, equipment, and working capital! And a term out to 10 years, longer if you are looking to purchase the real estate.

If you are interested in pursuing the many financing options including an SBA loan or in learning more of the details, please send us a message, and we will be pleased to discuss this further!

This article is for informational purposes. We recommend speaking with one of our financial professionals regarding your specific business needs to ensure you are considering all the possible options.

Galen “Chuck” Lemar is the owner and Managing Member of Lemar Financing and Leasing dba Affiliates Capital, providing financing programs to many industries especially in Health & Fitness. Lemar, a former banker, was a Senior Vice President of Gold’s Gym International, the franchisor of fitness franchises as well as a Senior Vice President of Cybex International, a manufacturer of leading fitness equipment for fitness clubs, studios, hospitals, rehab centers, YMCAs, JCCs and many others in the fitness industry.

Join the Conversation!