By Janet Leung, Special AFS Contributor

By Janet Leung, Special AFS Contributor

In business, it is often said, “It’s always about the money”. And many of us are also familiar with the slogan that it “takes money to make money”...whether the money is personal capital, shareholder equity, or borrowed funds.

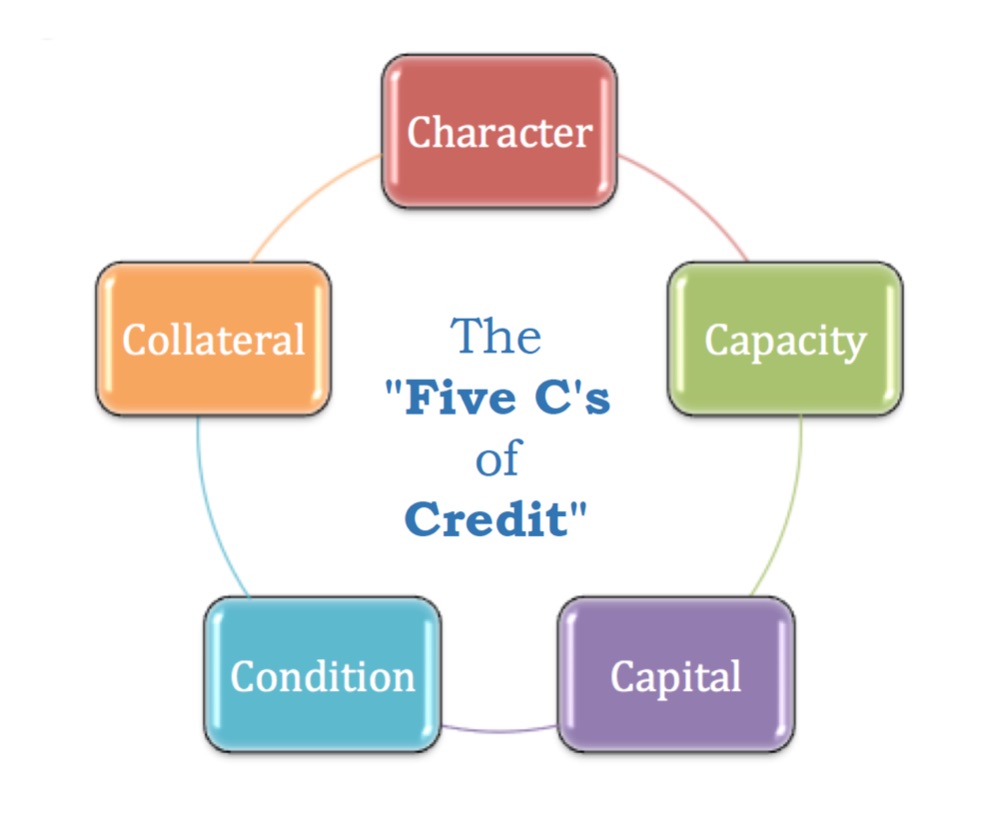

The credit industry has changed over the years and borrowing money is far less intimidating than it used to be. The “Five C’s of Credit”, which are character, capacity, capital, conditions, and collateral still apply, but less paperwork is required for credit requests, especially for businesses looking to finance less than $250,000.

Collateral and credit (history and performance) are still two very important “C’s” of the “5 C’s” of credit, especially personal and business credit history. Key essentials to personal credit are FICO scores and comparable credit.

Lenders place high value on how applicants have met obligations and how much credit other lenders have extended to the applicant. If the applicant is seeking, say $100,000, lenders want to see that the applicant has borrowed this amount in the past and re-paid the borrowing as promised.

Personal FICO scores are best regarded if 700 and above and again, the applicant's personal credit report is best regarded if it shows past borrowings of the size or greater than the amount currently being requested.

And the business has a credit rating, too. A business Paynet score of 700 is considered good by most lenders and is a good source for lenders to determine comparable credit. Of course, a Dun and Bradstreet (D&B) report is very helpful to lenders too, but in most cases, the applicant connects to D&B to join the D&B network.

The D&B report provides information on the business including dates started, address, officers/owners and borrowings, and lenders, nature of the business, and other information often helpful to creditors in considering credit requests.

It is “always about the money” and borrowing money for your business, whether for equipment, facility improvements, or working capital, is easier than you think and almost always a matter of how well you take care of your credit responsibilities. Your personal FICO score not only determines whether or not credit can be provided to your business but also the cost of the credit being offered.

Many commercial lenders adhere to a “risk based” pricing philosophy, meaning the less risk a credit request is determined to have, the better the interest rate provided to the applicant and the amount of money provided. The greater the risk the request is determined to have, the higher the cost of the credit. And often, it determines whether any credit is offered at all by the lender. So your personal and business credit ratings are vital to operating your business…key factors in providing an important source of working capital and the cost.

If you are interested in learning more about how to apply for credit and how you and your business stacks up in regards to credit, please send us a message, and we will be pleased to discuss this further!

This article is for informational purposes. We recommend speaking with one of our financial professionals regarding your specific business needs to ensure you and your business receive a custom solution.

Janet Leung is the Vice-President and Managing Member of Affiliates Capital, providing financing programs to many industries especially in Health & Fitness. Leung, who is also currently a ACSM certified personal trainer and NASM certified nutrition coach, has previously worked in financial and operational analytics and pricing for Gold’s Gym International, the franchisor of fitness franchises.

Join the Conversation!