Why the PHIT Act Is Important

Before understanding the impact of the Personal Health Incentive Today Act (PHIT), one must understand the world of Internal Revenue Service approved Health Savings Accounts (HSA) and Flexible Spending Accounts (FSA). IRS rules allow individuals to put pre-tax income into these special accounts, but the money can only be used for IRS-approved definitions of “healthy spending.” Currently, typical fitness-related expenditures do not qualify.

HSA and FSA accounts are enormous. For an HSA, an individual can contribute up to $3,350 annually into an account; and family coverage can be as high as $6,650. For FSA accounts, the  current contribution limit is $2,550 annually.

current contribution limit is $2,550 annually.

HSAs can grow tax-deferred in your account for later use. There’s no deadline for making a withdrawal: Consumers can reimburse themselves in future years for medical costs incurred now. Essentially, it’s tax-free money.

At the end of 2014, the HSA market exceeded $24 billion in assets covering more than 13 million accounts. Longer-term predictions are far greater: The Institute for HealthCare Consumerism estimates that 50 million Americans will be covered by HSA-qualified plans by 2019, and that HSA accounts will grow to 37 million.

FSA numbers are nearly as staggering, with over 35 million Americans using such accounts and growth at about 10% annually. FSAs cover IRS-acceptable medical expenditures not covered by health insurance programs.

The list of acceptable expenses is long and easily accessible online. The basic idea of both HSA and FSA are to give consumers tax break incentives to live healthier lives. It is a sad irony that among the IRS-approved expenses you won’t find anything related to fitness.

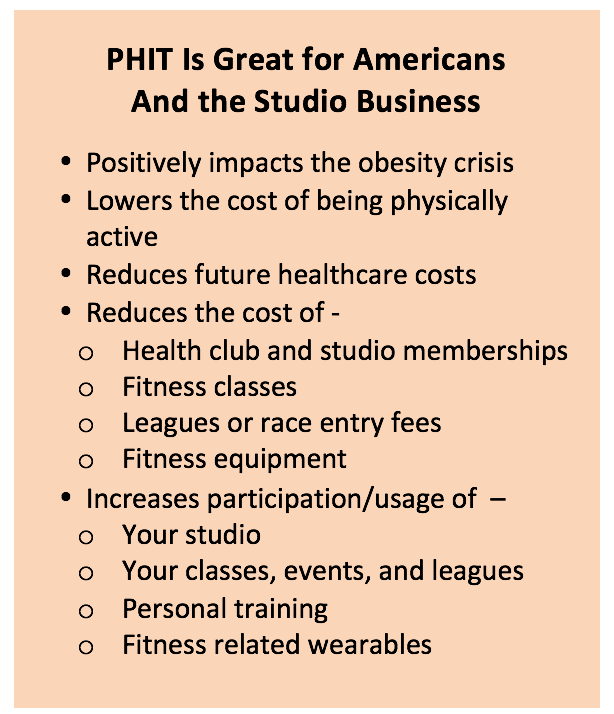

Enter PHIT. The Personal Health Investment (PHIT) Act seeks to expand the definition of “medical expense” to include a variety of fitness-related components as a form of prevention. Makes sense, right?

If adopted, PHIT eligible expenses would include gym and studio memberships, fitness & exercise classes, youth & adult sports’ registration fees, camps & clinics, and sports & fitness equipment solely used to participate in a physical activity.

Billions upon billions of tax-free dollars suddenly eligible for fitness activities. Like your studio business. Or your training business.

Worth supporting? To AFS, that’s the definition of “No Brainer.”

Make your voice be heard!

Join the Conversation!