By Janet Leung, Special AFS Contributor

By Janet Leung, Special AFS Contributor

During these unprecedented and very difficult economic times, the fitness industry is faced with what seems to be dire business decisions, but we suggest many need to adapt, adjust, and prepare during these times. For example, there have been increases in online coaching and programming, which helps with member retention. Behind the closed gym doors, owners are preparing on how they will adapt to the “new normal”.

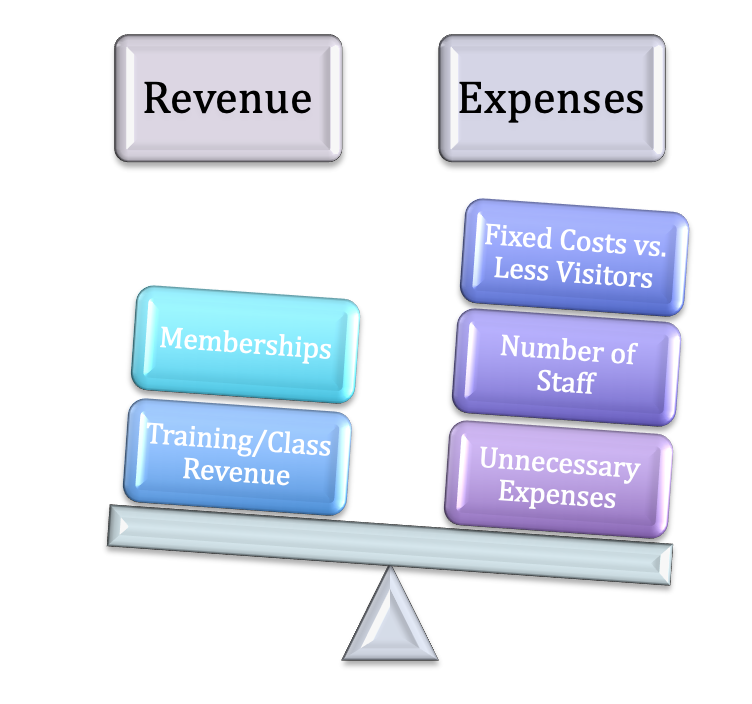

It is important during this time to revise your budget or review your latest profit and loss statements (P&L). The reality is that your budgets need to be tighter than ever.

Here are a few other suggestions to consider...

Most fitness businesses already felt the revenue loss whether its memberships or training services prior to non-essential businesses closing, and some have been worrying about how they will focus on member retention once the quarantine lifts. With millions of job losses, how many members will stay and prioritize fitness? First, look at the most recent, past revenue in your P&L and what you expect it to look like in your post-closing budget.

Most fitness businesses already felt the revenue loss whether its memberships or training services prior to non-essential businesses closing, and some have been worrying about how they will focus on member retention once the quarantine lifts. With millions of job losses, how many members will stay and prioritize fitness? First, look at the most recent, past revenue in your P&L and what you expect it to look like in your post-closing budget.

- Are you currently bringing in monthly membership revenue by offering virtual classes to your member base?

- If not, how much are you projecting to retain once your business re-opens while factoring in that members will slowly trickle back as the quarantine is lifted?

- Are you utilizing your trainers/group exercise instructors to teach classes and charging for personal sessions?

- Have you discovered your virtual class/session niche in appealing to children, stressed working clients, maintaining athletic training for sports, or many others?

- Maintaining virtual classes even if they are complimentary can go a long way in engaging your member base and staying at the forefront of their minds, as level of engagement directly correlates with member attrition.

- If you’re not generating revenue from virtual offerings, have you considered how you will jump-start the revenue stream once you re-open while maintaining a safe and comfortable environment?

- How much loss of revenue can your facility handle if you wanted to provide low cost re-join the gym membership specials after the quarantine?

- Have you surveyed your membership on their plans for resuming membership once the facility re-opens?

- Is renting out your equipment a viable revenue stream for you?

- Are your trainers or group exercise instructors physically going to clients’ homes or parks to teach sessions for an additional revenue stream?

For the expense side of your profit and loss statements, have you looked at each expense line to see where you may have unnecessary costs? Can you justify those expenses for the long-term?

- When your business re-opens, can you make enough revenue to cover the amount of fixed costs such as rent, electricity, water, etc.?

- How many more members would you need to sign up per month to justify your fixed costs?

- Is your landlord willing to work with you on free or lower rent for a period of time? Say 6 months to a year? Can you work with your landlord on cutting back on rented space?

- Will utility providers provide special terms to you? Your insurance provider?

- If your equipment is being financed, have you spoken with your lenders regarding deferred payments? Lower payments?

- Knowing that fewer memberships means less training and fewer visitors, is your staff the appropriate size?

- If you have too many instructors, are some of them working on your virtual offerings or will there be too many physically in the facility at one time?

- Is it appropriate to base trainer compensation strictly on training hours and fees?

- Are you paying for subscriptions or other features in your gym that are attractive extra member benefits to offer but you can cut back for the time being until your revenue re-builds?

- Since grocery stores and other businesses have cut back on hours, should you consider your hours of operation? Is it likely your members will work out at some of the more extreme hours you were offering prior to the quarantine?

Your business can take advantage of the quieter times to evaluate where they stand and what makes sense for profitability now and for when you re-open. Looking at a P&L or budget can be overwhelming, but there’s no better time than now.

If you are interested in consulting experts on your financial strategy, please send us a message, and we will be pleased to discuss this further!

This article is for informational purposes. We recommend speaking with one of our financial professionals regarding your specific business needs to ensure you are considering all the possible options.

Janet Leung is the Vice-President and Managing Member of Affiliates Capital, providing financing programs to many industries especially in Health & Fitness. Leung, who is also currently a ACSM certified personal trainer and NASM certified nutrition coach, has previously worked in financial and operational analytics and pricing for Gold’s Gym International, the franchisor of fitness franchises.

Join the Conversation!